April.29--In 2015, seaborne steel products trade accounted for around a fifth of minor bulk trade, having grown on average by 6% per annum since 2010. Recent growth has largely been driven by Chinese exports, which reached a record 113mt in 2015, accounting for 28% of global steel products exports. However, growing pressures both in China and abroad now seem to be slowing this old champion down.

Throwing Its Weight Around

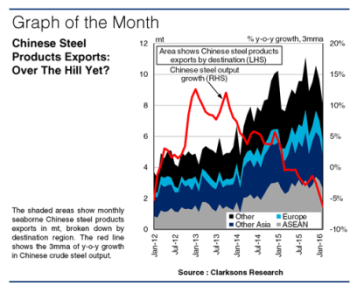

Chinese steel products exports grew 20% y-o-y in 2015, despite a 2% drop in Chinese crude steel output, as mills turned to the global market to help absorb the country’s chronic domestic surplus. The flood of cheap Chinese steel products exports disrupted markets for many other major steel producing countries, such as Japan and the US whose exports fell 4% and 18% respectively in 2015. Nonetheless, the sheer volume of growth in Chinese exports in 2015 supported global steel products trade expansion of 3%.

Sights Set

The majority of Chinese steel products exports have traditionally been shipped to other Asian countries and 2015 was no exception. Growing steel demand saw shipments to the ASEAN and ‘other Asian’ countries rise 31% and 14% respectively in 2015, to a combined 64mt. However, Chinese steel products exports to Europe recorded the firmest growth of the featured regions (47%) in 2015, while shipments to ‘other’ countries also grew by a healthy 9%, partly driven by demand in the Middle East. Despite such a broad range of destinations for Chinese steel products, several factors are expected to undermine growth in 2016.

Supply Strains

Chinese crude steel output fell 7% in January-February 2016 and while reports indicate an uptick in production in March and early April 2016, the Chinese government has set targets to cut the country’s steel output capacity by 200mt in the next 5 years. The gradual reduction of the country’s steel surplus is expected to reduce the need for Chinese mills to turn to exports, posing a risk to future seaborne export growth in 2016 and beyond.

Blows Parried?

Furthermore, several major steel importing countries, such as the USA and India have recently imposed import tariffs and minimum pricing levels, designed to protect their domestic steel industries from the flood of imported Chinese steel products. Chinese steel products exports to India fell 57% y-o-y in February 2016, following the introduction of the new measures. Given that Beijing has also since imposed a series of its own duties on imports of selected steel products, a build-up of global trade restrictions could further undermine growth in Chinese steel products exports in the near future.

So, this year Chinese steel products seem unlikely to record continued firm expansion, with current projections indicating limited growth. China appears to be following in the footsteps of a former steel heavyweight, Japan, whose steel products exports eventually waned over a number of years in the mid-1980s. While the Chinese steel industry is of course a different beast altogether, its punching power may now be close to peaking.

(Source: Clarksons)